Read, Write, Gamble

Crypto social's dying light

Today, Jesse Pollak announced that The Base App (formerly Coinbase Wallet), which recently embraced social via Farcaster’s decentralized social graph, will pivot further away from social and deeper into all things trading.

A month ago, Dan Romero wrote a similar post, pivoting Farcaster away from social and towards their wallet and trading infrastructure after “4.5 years with a social-first strategy…[and]…no product-market fit.”

Two platforms with similar intentions both retreat to the same haven. What went wrong?

Chris Dixon’s 2024 breakout book, Read Write Own, crystallized what drew so many of us to web3 in the first place. The chance to rebuild the internet the way it was meant to be. A place where an open, neutral protocol gave way to endless capabilities, connections, social and financial primitives, and true ownership. The book’s throughline embodies the core ethos of many builders: computer vs. casino.

I’ve been on Farcaster since early 2024 and have watched the network shift over time. I wanted it to work. But the data tells a more specific story than “crypto social failed.”

Decentralized social works. Financial applications with social signals work. Retroactively financialized social networks do not.

The story is in the numbers

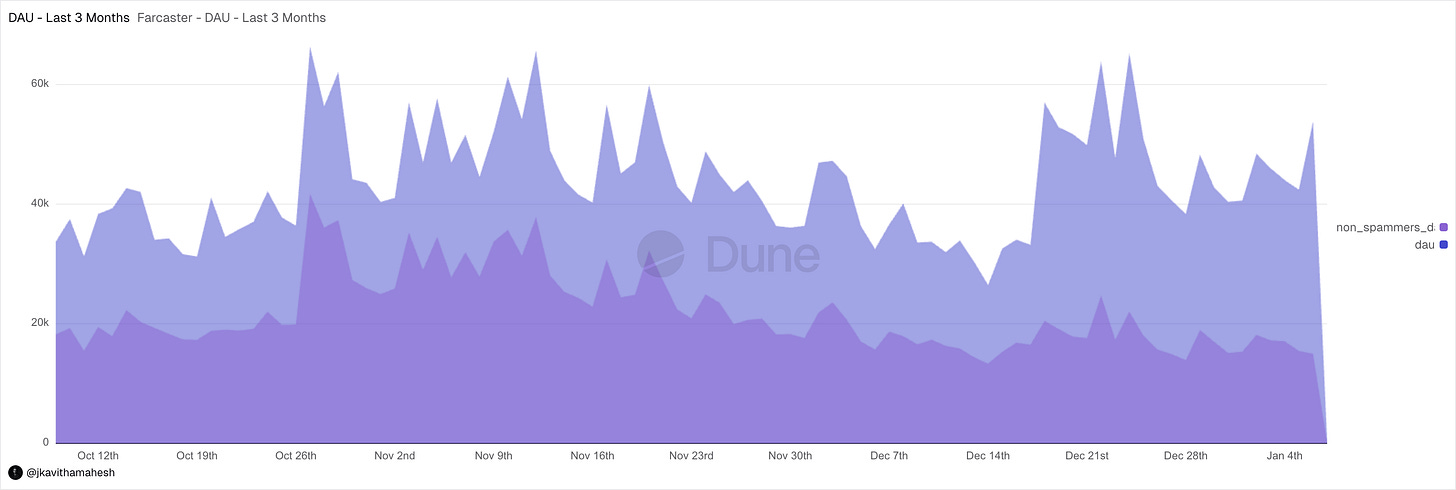

Farcaster Frames dropped on January 26, 2024, and DAU surged 400% from 2,200 to 24,700 in just over a week. The $DEGEN airdrop and tipping meta drove even more growth, and by July, 2024, Farcaster hit nearly 100,000 DAU.

By October 2025, Farcaster’s reported DAU figures had fallen to 40,000-60,000. Protocol revenue also cratered by 99% from the February 2024 peak. Due in part to the recent introduction of free registrations, Farcaster’s protocol revenue is now negligible at best.

Further, the active user base has, on the surface, benefited from the recent launch of The Base App, but the data shows that a staggering majority of active accounts are spam.

Revealed preference or strategic capitulation

Dan Romero’s announcement in December 2025 marked the end of Merkle Manufactory’s foray into a social-first strategy.

“Wallet has been growing, so we’re doubling down on that direction... We believe the best way to grow the number of peopleusing the protocol is a ‘come for the tool, stay for the network’ strategy.”

Dan Romero

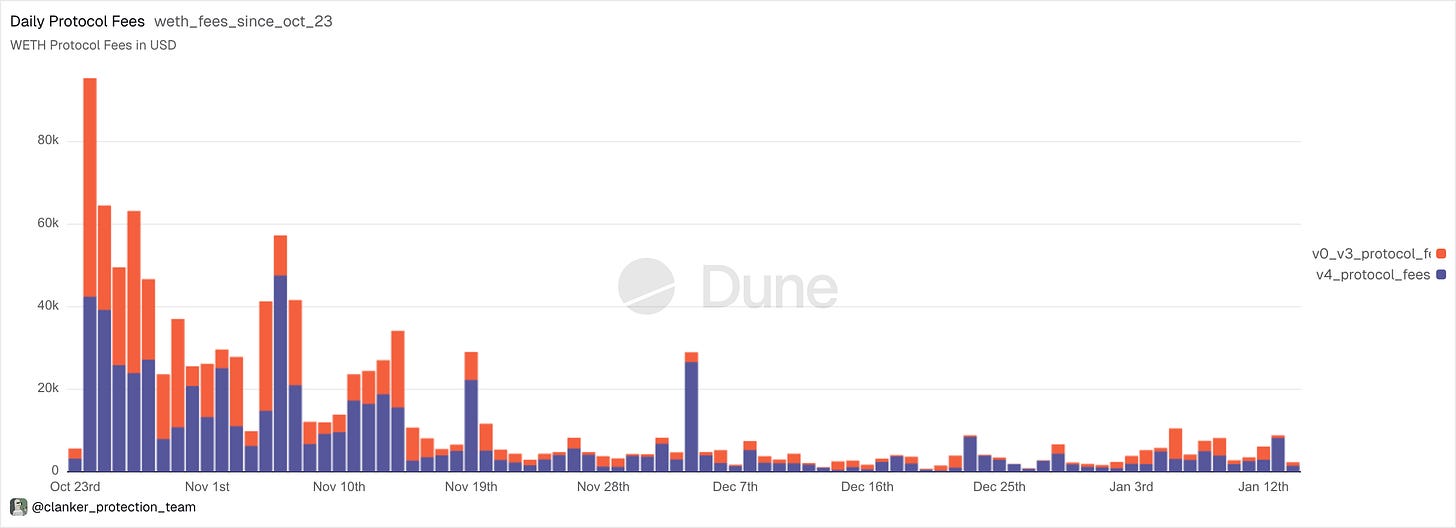

Prefaced by Farcaster’s acquisition of Clanker on October 23, 2025, this pivot should have come as no surprise to anyone watching. Clanker, the AI-powered token deployer on Base, generates meaningful fees daily.

No wonder Farcaster is pivoting its business model from social networking to token infrastructure and trading. Farcaster raised $180M across two rounds led by the biggest VCs on earth, including a16z, Paradigm, Union Square, and others, and meanwhile operates at a 1.6% revenue-to-funding ratio.

In just 2.5 months since the acquisition, Clanker has made roughly one quarter of Farcaster’s lifetime revenue. In its first two weeks, Clanker generated more fees than Farcaster has in five years. Over its lifetime, Clanker’s $50M+ revenue exceeds Farcaster’s by nearly 20x.

Lens Protocol tells an even more damning story

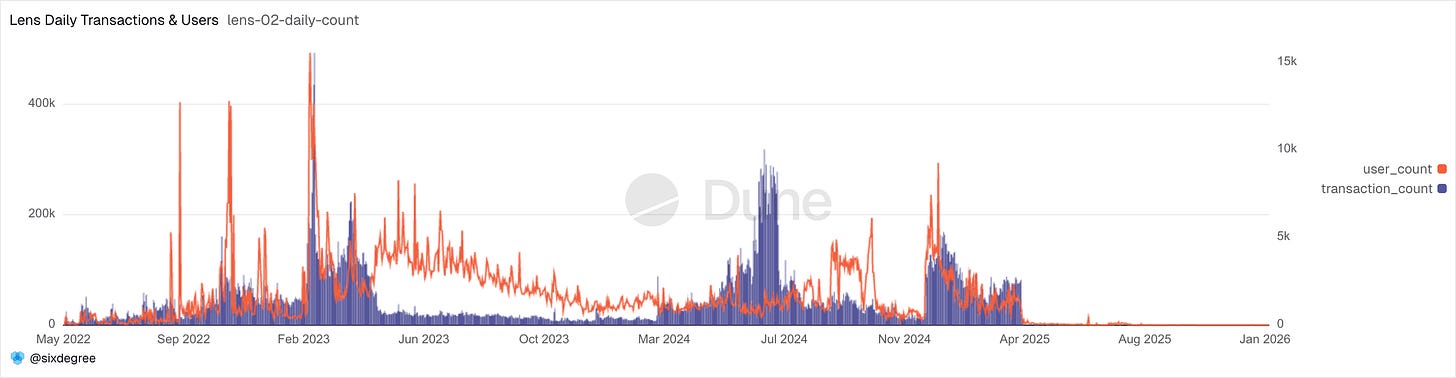

Aave founder-backed Lens Protocol pursued a different technical approach but achieved similar results. Lens raised $46M across two rounds, starting in June 2023, and achieved notable technical milestones, including one of the space’s largest data migrations in history. In April 2025, Lens successfully moved 650,000 user accounts, 16M+ posts, 28M+ follower connections, and 50M+ reactions to its custom-built Lens Chain.

Despite their technical prowess, daily users have been trending toward zero since the migration.

One could argue that Lens’s deeper commitment to putting all social actions onchain worked against it.

Lens’s failure isn’t proof that decentralized social cannot work. It proves that financialized decentralized social cannot work.

Bluesky proves that decentralization works sans tokenization

Bluesky’s approach completely nukes the SocialFi premise and simply leans into creating a recognizable version of social media on a decentralized protocol. Their success has led to a user base of 40M+.

That’s 70x the users of Farcaster, despite raising only a fraction (roughly 1/5) of their funding.

CEO Jay Graber’s previous experience in the crypto space led her to drive her product in a different direction. She clearly understands the benefits of decentralization but chose to avoid the speculative mechanisms that create perverse incentives across a social network.

While catalysts like mass exodus from X due to Elon Musk’s political leanings or Brazil’s temporary ban on X have driven supranormal growth spikes (similar to Bluesky’s crypto counterparts) the outcomes have differed. Whereas moments like $DEGEN or the Lens migration created quick, unsustained growth spurts, Bluesky has managed to retain many of its users and sees between 3.5M and 4M users log on daily.

The part that drives me insane is that we know hyperfinancialization doesn’t mesh with social.

Friend Tech’s collapse was the cautionary tale

I hate to keep bringing up Friend Tech, but they represent this vertical’s most catastrophic failure. They launched in August 2023 and attracted $52M in TVL, generating over $2M in daily fees at their peak. By September 2024, the smart contract was transferred to a null address, and the project was abandoned. The $FRIEND token collapsed 98% from $3 to $0.08, daily fees were lucky to tap three figures, and DAU dropped to single digits.

While the token-gated chats with your favorite influencers were novel, the bonding curve implementation created a Ponzi-esque dynamic that ultimately led to a prisoner’s dilemma with your “friends.”

If new friends didn’t join the chat, your only option was to dump. And often, those selling were the influencers themselves.

The May 2024 airdrop briefly renewed interest in the platform, but only long enough for airdrop farmers to claim, dump, and flee. Paradigm backed this venture as well, and it ended up being a write-down for everyone involved, except perhaps the founders, who extracted $44M before riding off into the sunset.

SocialFi is an oxymoron. Financializing social interactions attracts one type of person: speculators.

The hybrid approach

There are examples of finance apps with a social layer that have worked.

Coinbase is acquiring the Solana-focused trading interface, Vector, for example. Vector enables users to sign in with their X account, see what their friends and followers are trading, copy their trades, and create trading “groups.” There is no social interaction beyond seeing what people in your network are doing.

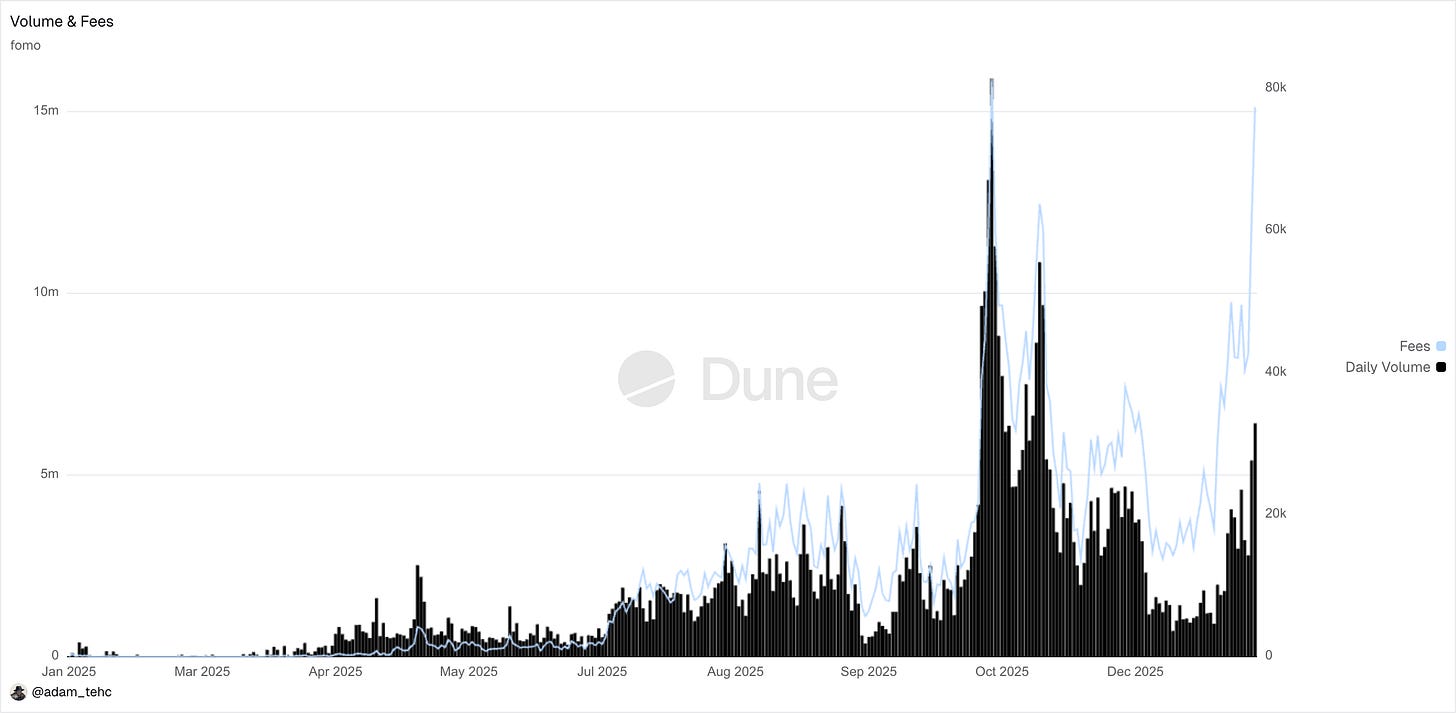

Similarly, FOMO has broken out recently and become the go-to trading app for Crypto Twitter (CT). Same idea; users log in with X, see what’s trending among their friends, and ape together strong. Their frictionless embedded wallet experience is top-notch and is attracting a meaningful number of users, volume, and fees.

Financialization was the wrong thesis

Crypto social continues to test whether tokenization or other financial incentives can effectively bootstrap network effects. While they can certainly attract users, this thesis does not produce sustainable networks. Network effects are driven by culture, shared values, and usefulness. Speculation drives people through, not in.

Dan Romero and Jesse Pollak’s collective pivots are not individual failures. They represent a verdict on the hypothesis. The uncomfortable truth that token incentives do not catalyze growth.

Even if the future of crypto is social, the future of social is clearly not crypto.

Sources (non-comprehensive list):

Dune Analytics - Farcaster vs Lens dashboard: https://dune.com/filarm/lens-vs-farcaster

BlockEden - “Farcaster in 2025: The Protocol Paradox”: https://blockeden.xyz/blog/2025/10/28/farcaster-in-2025-the-protocol-paradox/

Cryptopolitan - “Farcaster’s daily active users drop 40%”: https://www.cryptopolitan.com/farcasters-daily-active-users-drop-40/

AInvest - “Farcaster’s Strategic Pivot”: https://www.ainvest.com/news/farcaster-strategic-pivot-social-network-wallet-protocol-2512/

Blockchain Reporter - “Farcaster Cast Activity Drops 60%”: https://blockchainreporter.net/socialfi-crypto-platform-farcasters-cast-activity-drops-60-in-6-months

BlockEden - “Farcaster in 2025: The Protocol Paradox”: https://blockeden.xyz/blog/2025/10/28/farcaster-in-2025-the-protocol-paradox/

Great article. I agree on many points, but the conclusion that "the future of social is not crypto" feels premature.

Crypto offers far more than tokenization or incentives. Ethereum is about credible neutrality, self-custody, and verifiable execution. These primitives haven't surfaced meaningfully in social yet because crypto is still small and not growing. The story is far from over.

Farcaster has roughly the same number of quality users (~30k with Neynar score >0.7) now as it did in December 2024 [1][2]. When a tiny group drives all the fees [3], what happens when a few leave, go on holiday, or the incentives end? That's not sustainable. Moat built overnight is lost overnight.

Jury is still out on financialized social. We simply don't have the critical mass of legit users to know. The problem is how we bring new users. Measuring success by fees doesn't help when it's just farming. BTW wild that it's 2026 and we still equate an address with a real user.

How do we get people excited about crypto again? Maybe they don't need to know it's crypto at all. Credible neutrality, self-custody, and verifiable execution should be the default, not the exception. That's what crypto offers. That's what users deserve, including in social.

The future of crypto is determined by culture, shared values, and usefulness.

PS: The Lens graph shows Polygon activity only. The drop to zero reflects the migration to Lens Chain, not user abandonment.

Sources:

[1] Neynar. "Neynar User Quality Score." Retrieved January 15, 2026. Screenshot dated December 5, 2024. https://docs.neynar.com/docs/neynar-user-quality-score

[2] Neynar. "Neynar Score Distribution Dashboard." Retrieved January 15, 2026. https://data.hubs.neynar.com/public/dashboards/UPkT4B8bDMCo952MXrHWyFCh1OJqA9cfFZm0BCJo

[3] Dune Analytics. "FOMO Fee Tier Distribution." Query #6533493. https://dune.com/queries/6533493

all the sources for my reply below

[1] Neynar. "Neynar User Quality Score." Retrieved January 15, 2026. Screenshot dated December 5, 2024. https://docs.neynar.com/docs/neynar-user-quality-score

[2] Neynar. "Neynar Score Distribution Dashboard." Retrieved January 15, 2026. https://data.hubs.neynar.com/public/dashboards/UPkT4B8bDMCo952MXrHWyFCh1OJqA9cfFZm0BCJo

[3] Dune Analytics. "FOMO Fee Tier Distribution." Query #6533493. https://dune.com/queries/6533493